Partners Providing Lasting Impact by Investing in Forever

Read More

Retired Doctor Starts Seminarian Education Endowment

While Dr. Bonita “Bonnie” Bachl was doing her physician’s residency in pathology in New York City, she attended Mass at St. Catherine of Siena located on the Upper East Side of Manhattan. The Dominican Friars ran the church. It was during her time at St. Catherine, while in her residency and then later after she retired as head of laboratory medicine at a major New York area hospital, that Bonnie…

Read More

Donor’s planned gift creates lasting scholarship support

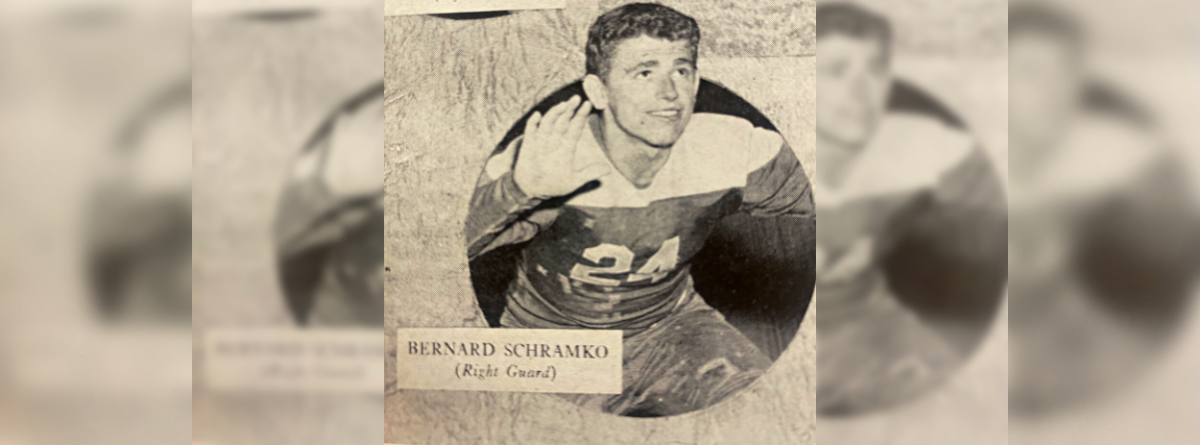

Seventeen students from three Catholic high schools were part of the inaugural class of scholarship recipients from the Bernard Schramko Memorial Scholarship Fund managed by the Catholic Foundation. These annual scholarships awards are made possible through a bequest from the estate of Bernard M. Schramko. Bernard Schramko Memorial Scholarship Fund Mr. Schramko, a 1951 graduate of Allentown Central Catholic High School, died July 2019. He stipulated in his will that…

Read More

Age 70 1/2? Support Catholic Causes and Avoid Taxes With Qualified Charitable Distributions

Supporters of Catholic causes can ensure their favorite organization continues fulfilling its missions by directing distributions from their tax-deferred retirement accounts to an endowment or donor designated fund managed by the Catholic Foundation of Eastern Pennsylvania. This is a win for both the Catholic organization and the donor/taxpayer. With qualified charitable distributions, they can begin as young as 70 1/2 years old. What Are Qualified Charitable Distributions? If you are age 70½…

Read More

David Bosich, Parishioner and Donor at Holy Family Parish, Nazareth

The Catholic Foundation helped me realize my dream of helping youth in our parish. By starting the Youth Ministry Endowment Fund now, I could see the impact while I was still alive. By also including the endowment fund in my will, as a beneficiary for my insurance and investments, and as a preference for memorial gifts, the impact for your in the future will live on forever. Holy Family Youth…

Read More

Michael and Christine Ippoliti, Parishioners of Our Lady of Perpetual Help Parish, Bethlehem

Knowing the impact Catholic education had on our lives, Christine and I wanted current and future OLPH students to have the same opportunity. I quickly discovered that the Catholic Foundation’s independent professional approach, investment expertise and passion for helping Catholic parishes and schools remain viable cannot be matched by any other organization in our region. The establishment of this donor designated fund will ensure the long-term financial sustainability of Our…

Read More

Bill Kirwan, Chairman of the Nativity HS Board of Directors, Pottsville

It made sense for Nativity High School to open these funds with the Catholic Foundation. The board is considering establishing other scholarship endowment funds to keep the cost of tuition affordable for our families. (more…)

Read More

Join Us for the 2022 State of the Foundation Meetings

The Catholic Foundation of Eastern Pennsylvania invites you to join us for the 2022 State of the Foundation Meetings being held at of three different locations within the communities we serve. CLICK HERE TO REGISTER Dates, Times & Locations for State of the Foundation Meetings October 5, at 9:00am: The John Paul II Center for Special Learning, Shillington (Berks County)October 12, at 4:30pm: Mercy School for Special Learning, Allentown (Leigh…

Read More